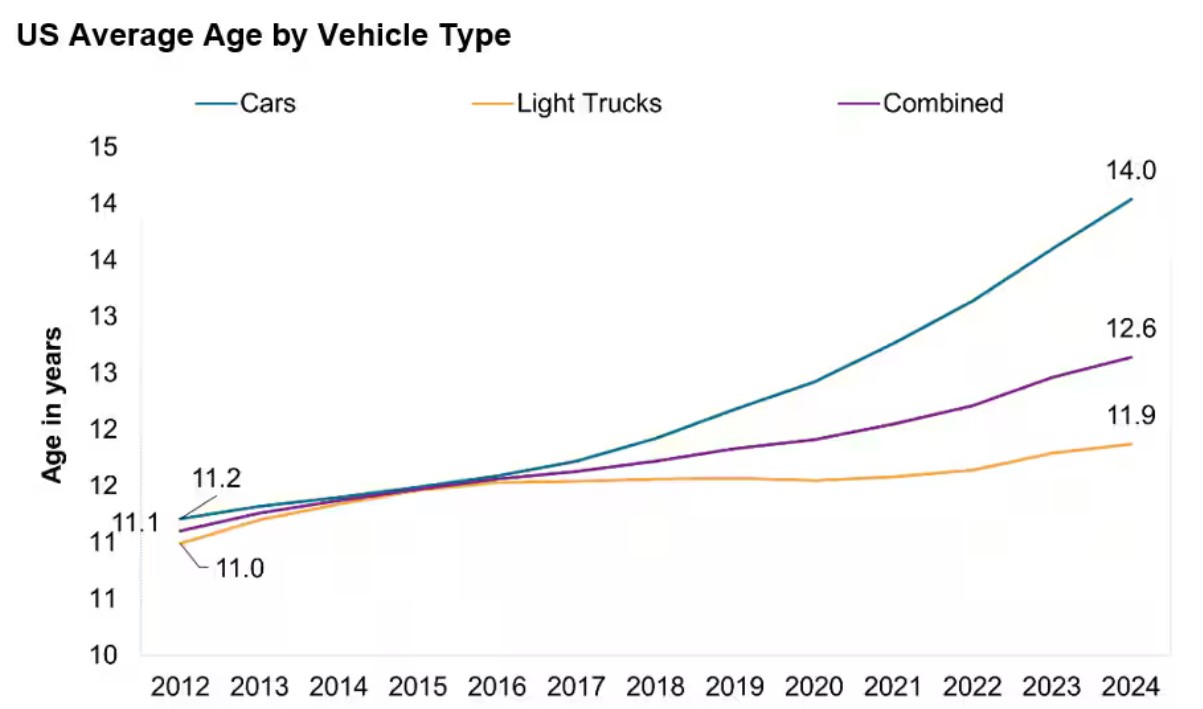

The age of vehicles on the road in the United States has hit a new record. According to the latest data from S&P Global Mobility, the average age of cars and light trucks has climbed to 12.6 years in 2024, marking a two-month increase over the previous year. While this trend indicates a slowdown in the aging process as new registrations begin to stabilize, it presents significant opportunities for the aftermarket and vehicle service sectors, particularly for those involved in the hybrid vehicle battery space.

Summary: The Road Ahead

- Cars Are Getting Older: The average age of all vehicles in the U.S. has reached a record 12.6 years in 2024, with cars now staying on the road for 14 years. The average hybrid vehicle tends to last even longer, further emphasizing the trend of aging vehicles.

- Vehicles Are Getting Bigger: There’s a continued shift towards larger utility vehicles, such as SUVs and light trucks, reshaping the composition of the U.S. vehicle fleet.

- The Shift to Hybrids: Hybrid vehicles are becoming more popular as a stepping stone towards full electric vehicles, with registrations surging by 181% from 2021 to 2024.

Why Are Vehicles Staying on the Road Longer?

Several factors contribute to the growing age of vehicles in the U.S. market. The average transaction price for a new vehicle reached $47,218 in March 2024, making it increasingly difficult for consumers to afford new cars. Persistent inflation, high interest rates, and concerns about the shift to electric vehicles (EVs) further complicate the decision to replace an aging vehicle. As a result, more consumers are opting to keep their cars longer, leading to an older vehicle fleet with many vehicles remaining in operation for over 14 years. For hybrid vehicles, the lifespan is even longer, reflecting their durability and continued relevance in the market.

The Aftermarket’s Sweet Spot: A Growing Opportunity

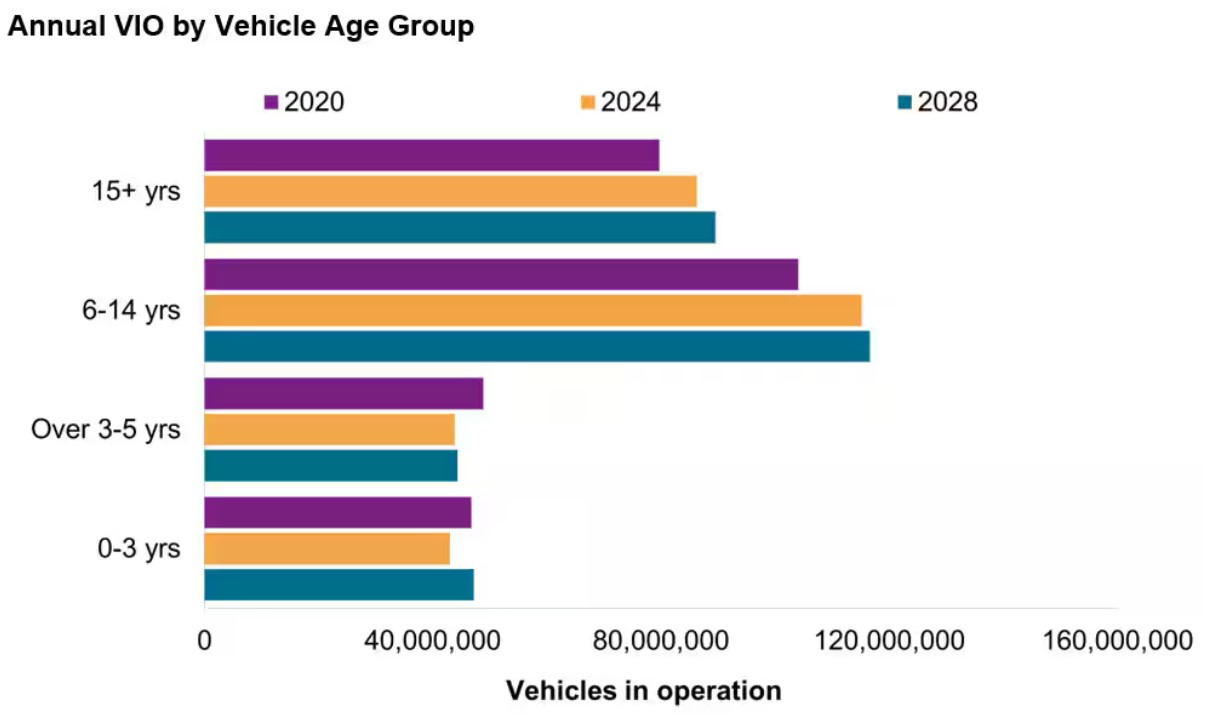

As vehicles age, the demand for repairs and maintenance inevitably rises. Vehicles in the 6-to-14-year-old range are particularly significant for the aftermarket industry. According to S&P Global Mobility, this segment is expected to grow by 12% by 2028 compared to 2020, with these vehicles often on their second or third owner, making them prime candidates for aftermarket services.

"With more than 110 million vehicles in that sweet spot — reflecting nearly 38% of the fleet on the road — we expect continued growth in the volume of vehicles in that age range to rise to an estimated 40% through 2028," said Todd Campau, Associate Director of Aftermarket Solutions at S&P Global Mobility.

For companies specializing in hybrid vehicle batteries, this trend represents a golden opportunity. As hybrid vehicles continue to age, the demand for hybrid battery replacements and related services is poised to increase, particularly as these vehicles remain a popular choice among consumers who are not yet ready to fully commit to electric vehicles.

Hybrid Vehicles: A Stepping Stone to EVs

The growing preference for hybrid vehicles is another critical factor reshaping the aftermarket landscape. While the overall scrappage rate for vehicles in the U.S. remains steady at around 4.6%, hybrid vehicles are rapidly increasing their share of the fleet. As of January 2024, only 18% of new hybrids are replacing old ones being scrapped, signaling that consumers are choosing hybrids as a transitional step towards full electric vehicles.

Between January 2021 and January 2024, hybrid vehicle registrations in the U.S. surged by 181%, reaching 1.4 million. This trend indicates that consumers are increasingly opting for hybrids as a way to experience some of the benefits of EVs, such as improved fuel efficiency and reduced emissions, without fully abandoning the familiarity of internal combustion engines.

What Does This Mean for the Hybrid Battery Market?

For companies in the hybrid vehicle battery space, the aging vehicle fleet and the rise of hybrid vehicles present a unique set of opportunities. As more hybrids enter the aftermarket 'sweet spot,' the demand for battery replacements and servicing will grow. Furthermore, the increasing average age of vehicles, combined with the growing popularity of hybrids, suggests that the aftermarket sector will continue to expand over the next decade.

Michael Cardone III, CEO of A3 Global, emphasized the importance of this trend, stating, "As the fleet ages and hybrid technology becomes more widespread, we're entering a period of significant growth in the demand for hybrid battery replacements. Companies that can innovate and provide high-quality solutions will be well-positioned to capitalize on this expanding market."

Looking Ahead: The Road to EV Adoption

While electric vehicles are also gaining ground, with 3.2 million EVs on the road as of January 2024, the pace of EV adoption has been slower than some automakers anticipated. The average age of EVs in the U.S. has held steady at 3.5 years since 2019. This suggests that while EVs are growing in number, their market share remains relatively small compared to the broader vehicle fleet.

As the market evolves, companies in the hybrid battery space will need to stay agile, adapting to the changing landscape and capitalizing on the growing need for aftermarket services. The future of the automotive industry may be electric, but the present is decidedly hybrid — and for businesses in the battery space, that’s fuel for thought.

The Aging Vehicle Fleet and Its Impact on the Hybrid Battery Market

As the automotive landscape continues to evolve, it's clear that the aging vehicle fleet and the rise of hybrids present a wealth of opportunities for businesses in the aftermarket industry. If you're interested in learning more about how to capitalize on this booming aftermarket opportunity, don't hesitate to contact A3 Global. Our expertise in hybrid battery and EV battery solutions positions us perfectly to help you navigate and thrive in this growing market.